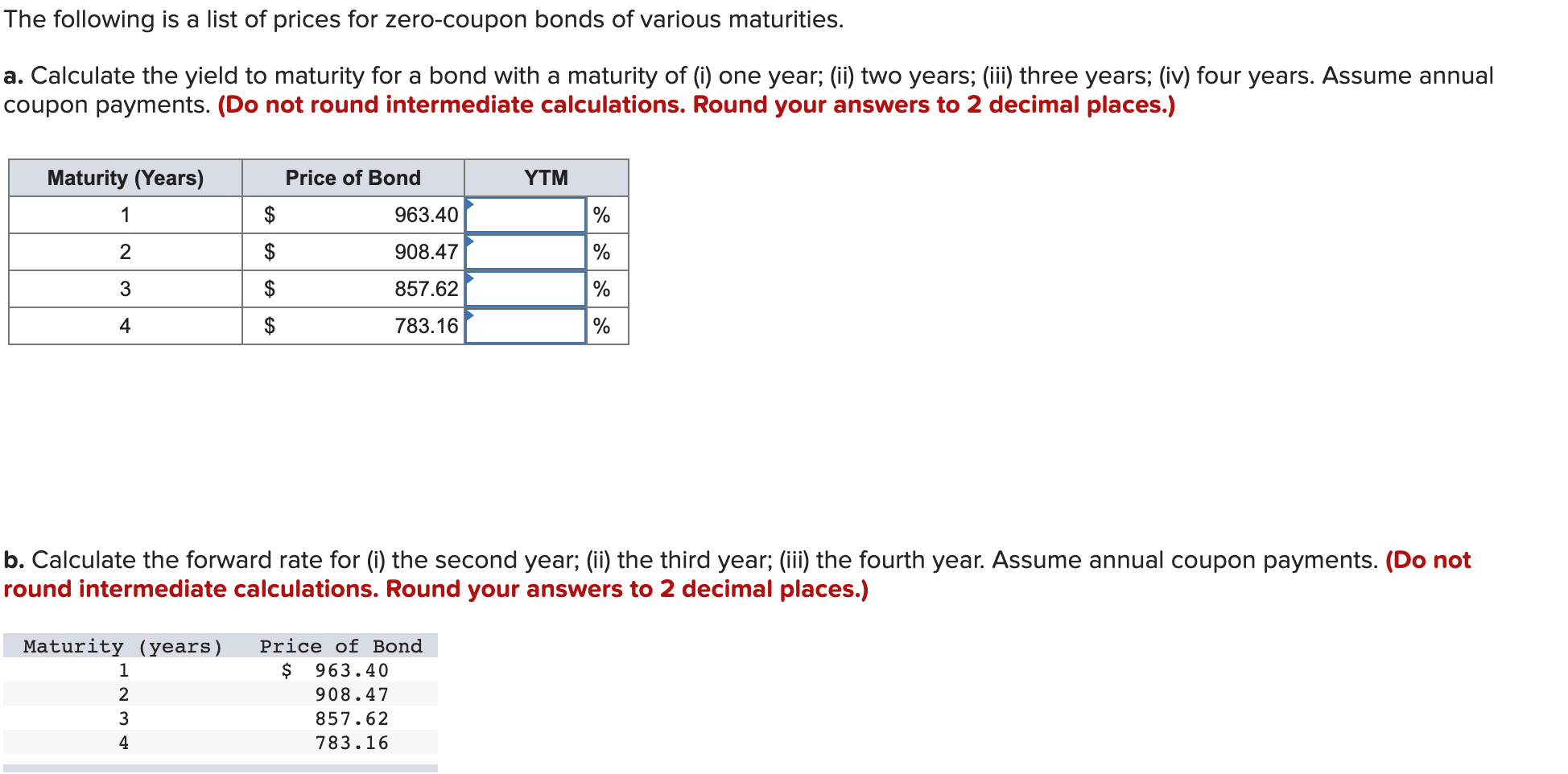

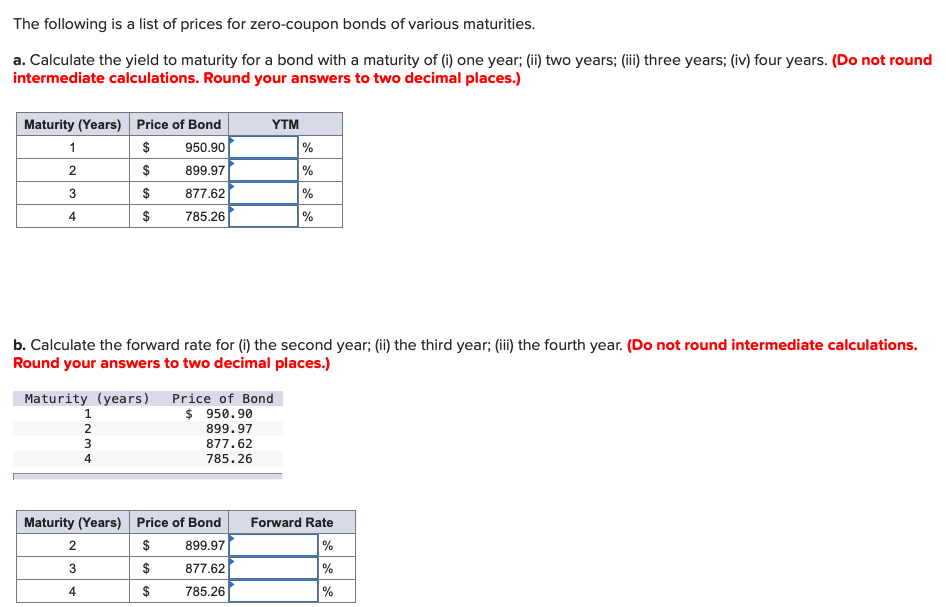

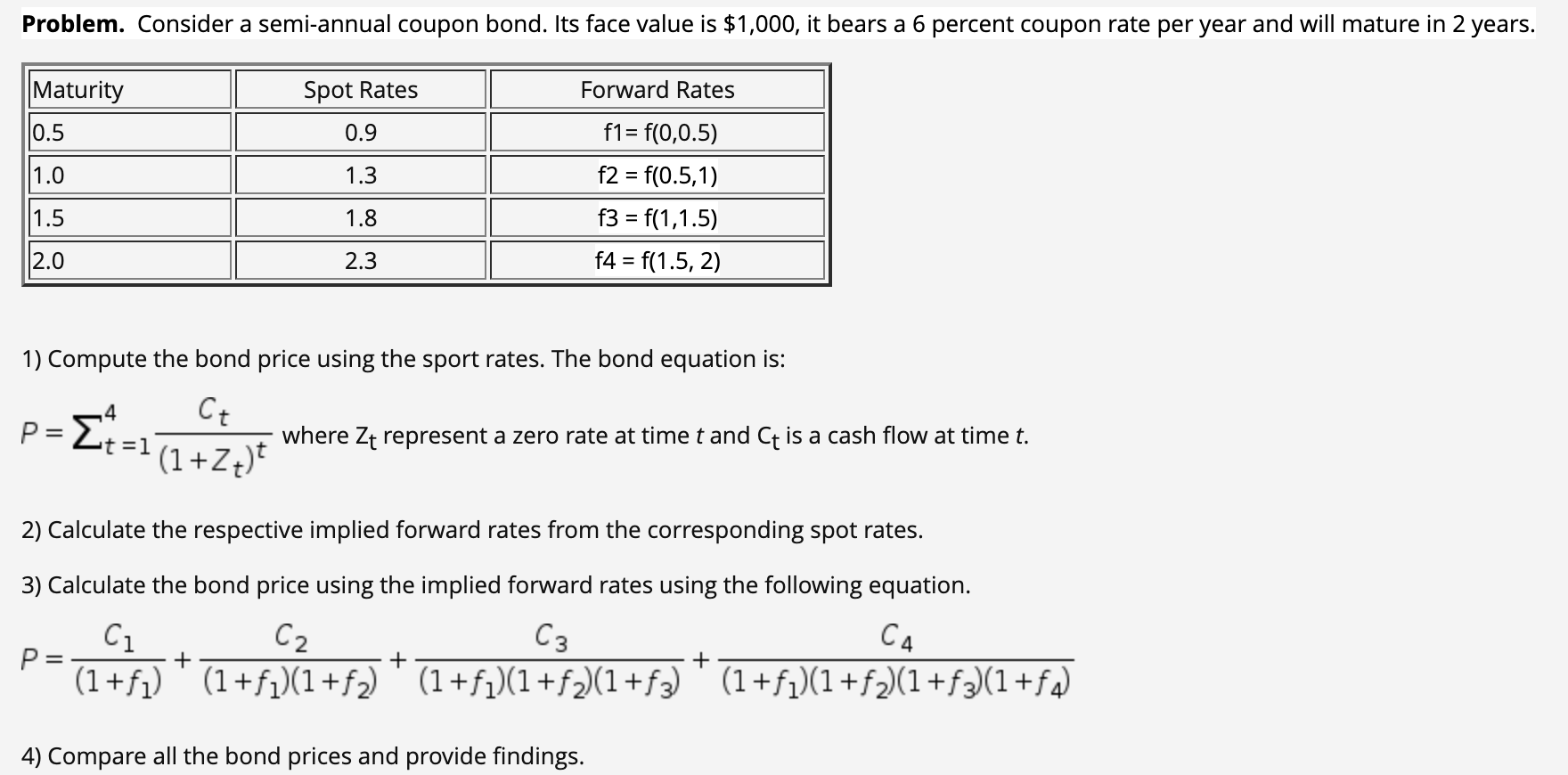

1 Yield Curves and Rate of Return. 2 Yield Curves Yield Curves Yield curves measure the level of interest rates across a maturity spectrum (e.g., overnight. - ppt download

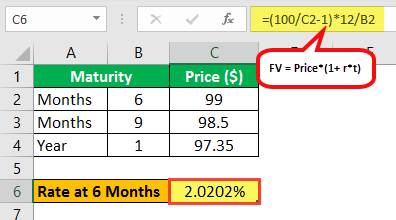

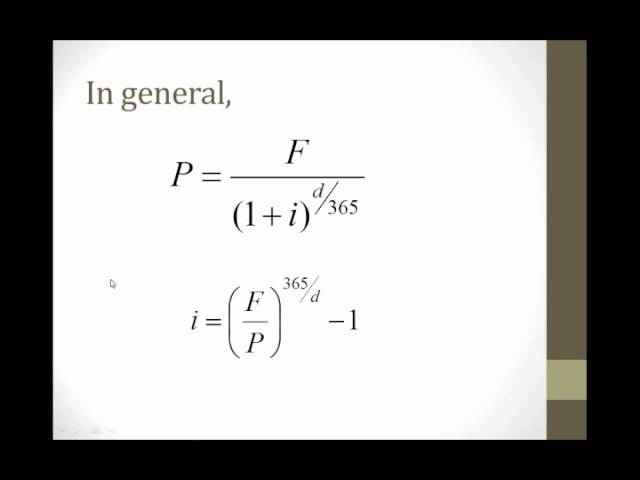

How to calculate the values of Forward Rate Agreements & Forward Foreign Exchange Rates - FinanceTrainingCourse.com

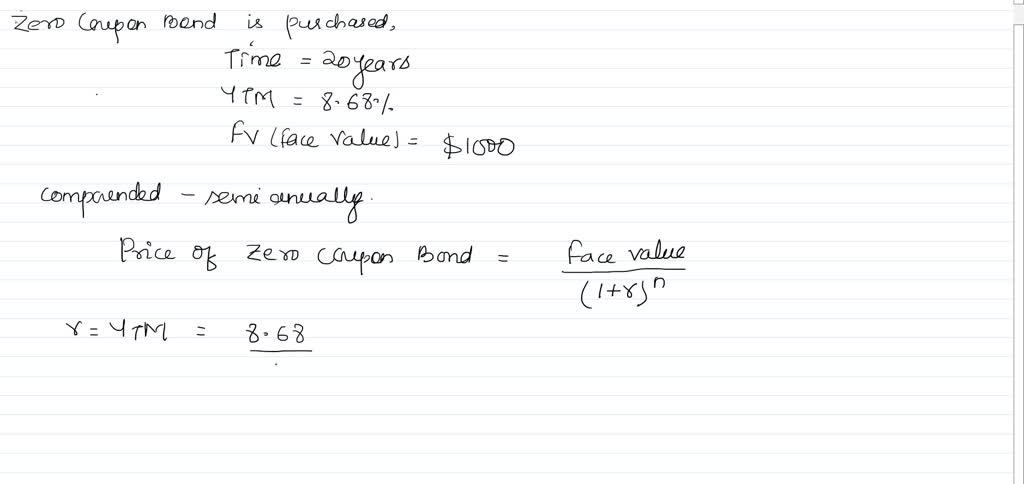

SOLVED: Calculate the price of a zero-coupon bond that matures in 10 years if the market interest rate is 6 percent. (Assume semiannual compounding and 1,000 par value.) A.)553.68 B.) 558.66 C.)940.00 D.) 1,000.00

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)