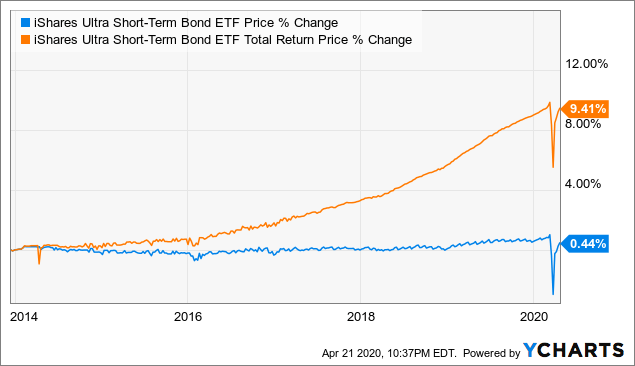

iShares Ultra Short-Term Bond ETF: A Safe Haven For Investors Seeking Stable Income (BATS:ICSH) | Seeking Alpha

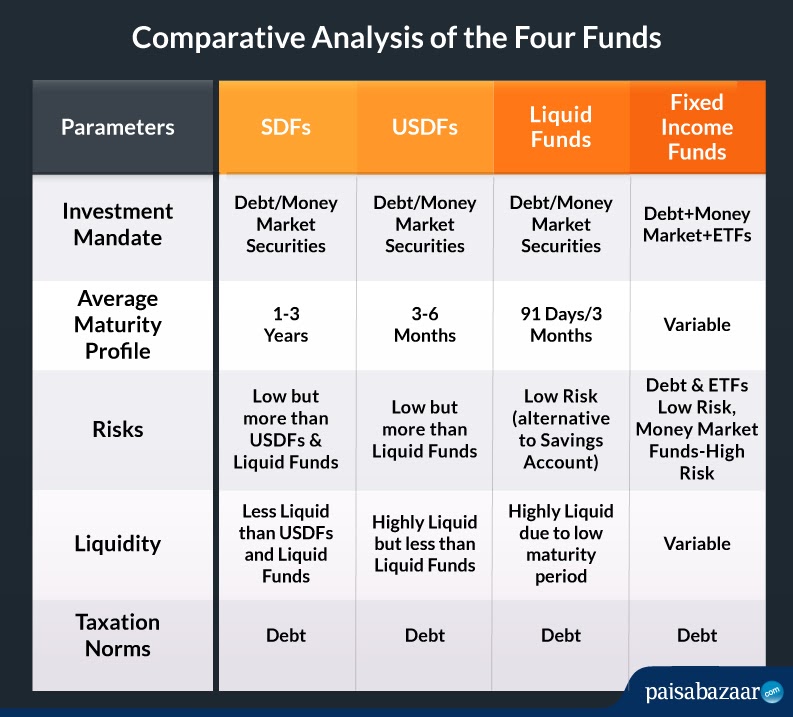

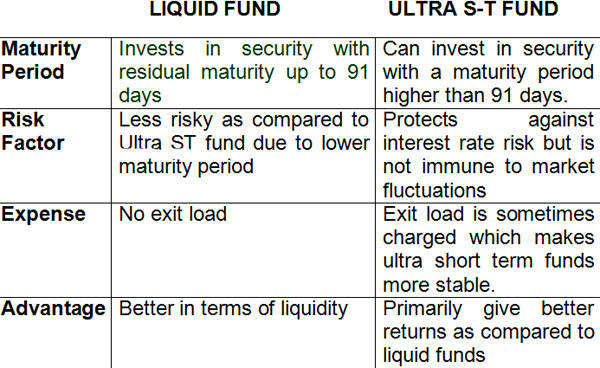

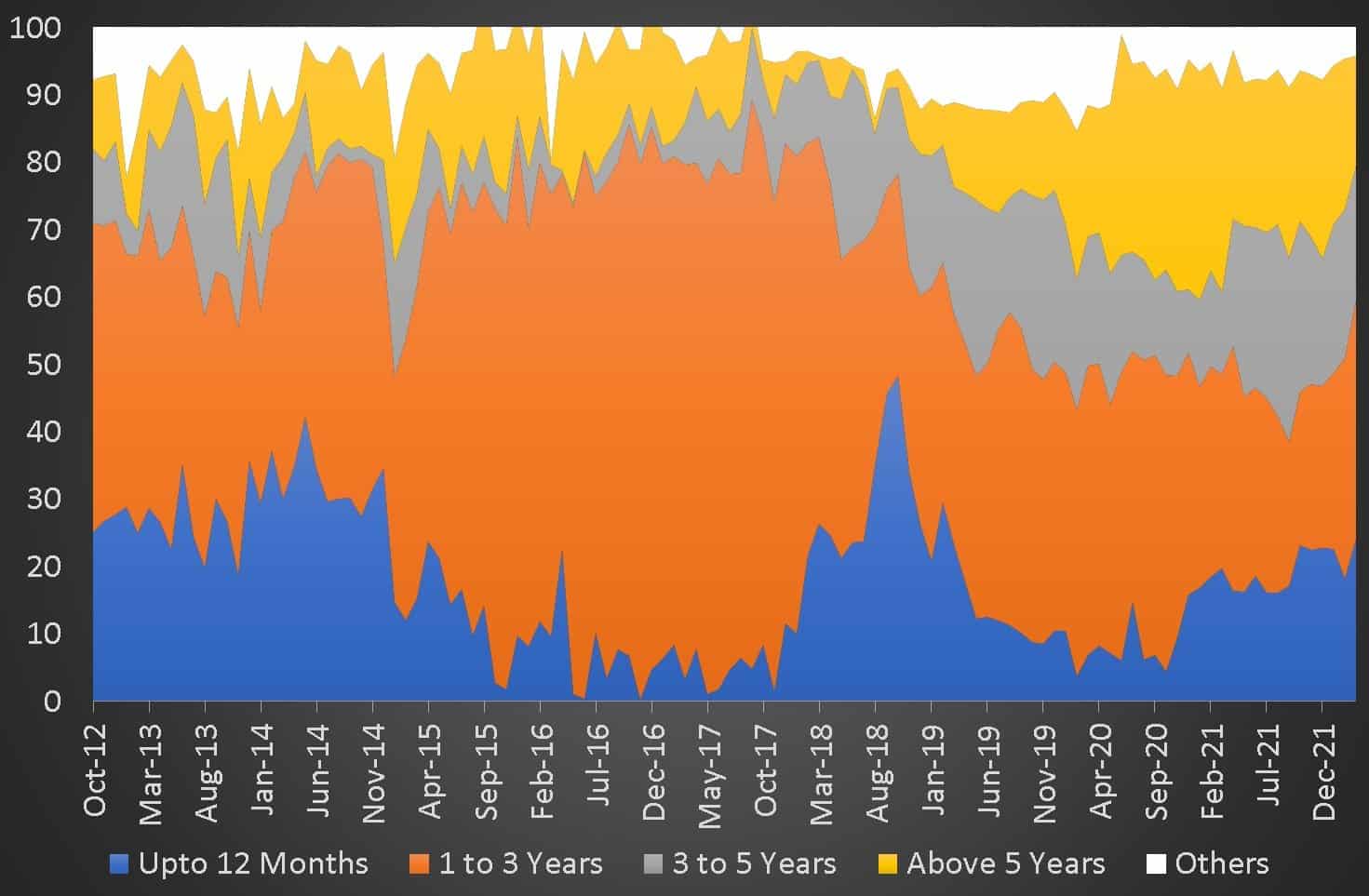

What is Ultra Short Term Funds? Definition of Ultra Short Term Funds, Ultra Short Term Funds Meaning - The Economic Times

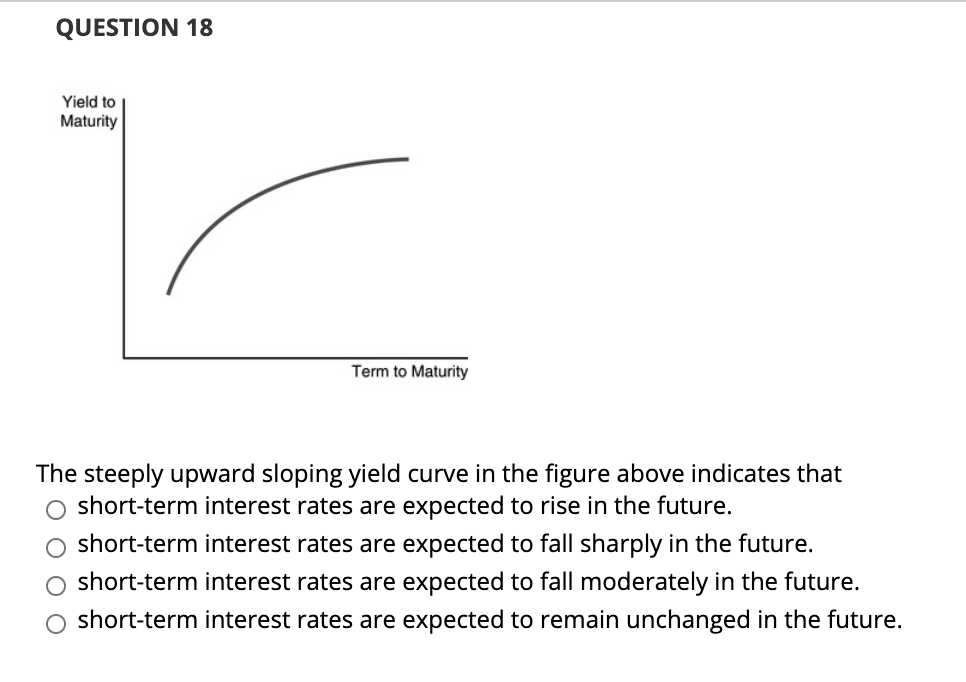

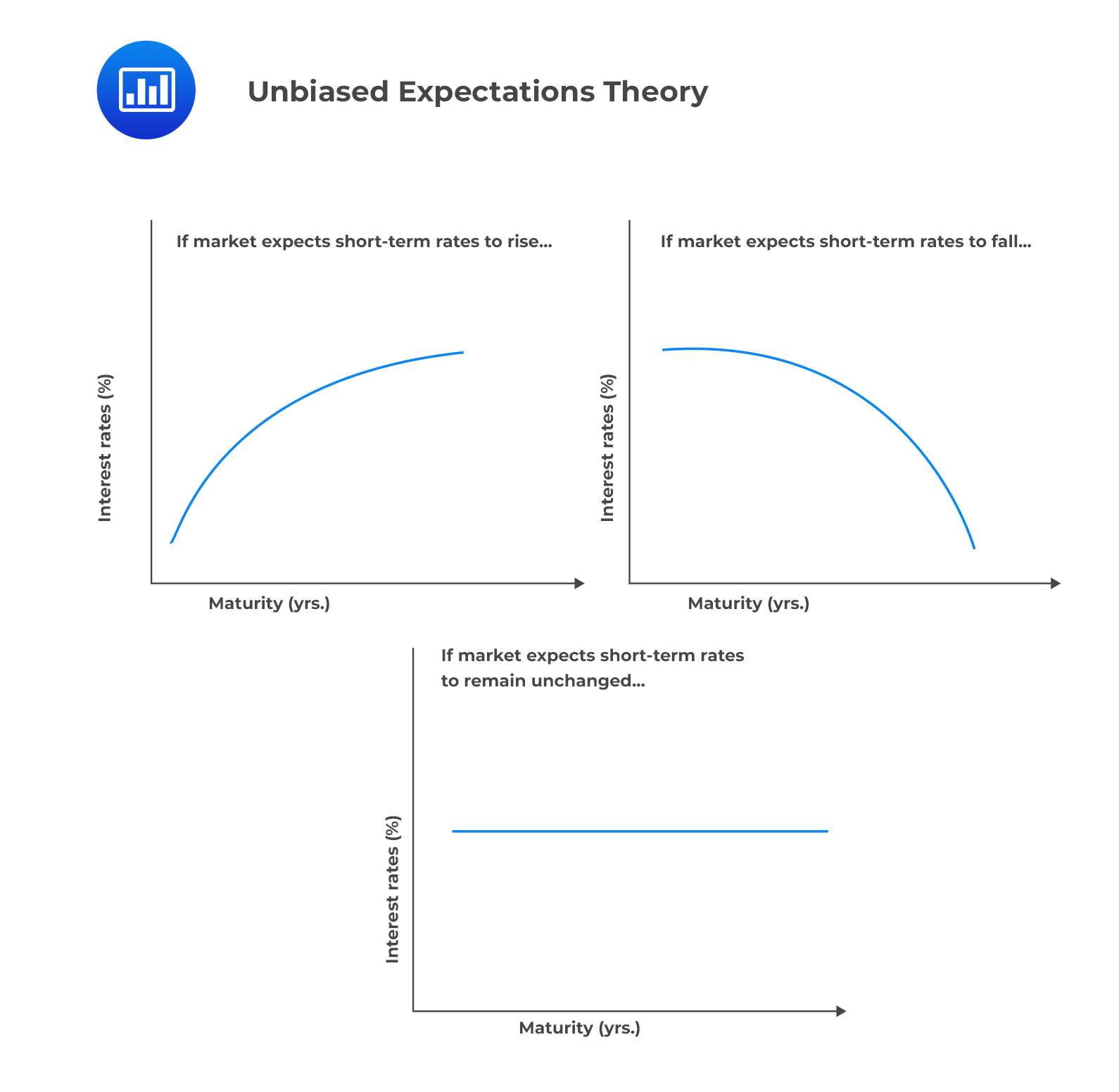

Traditional Theories of the Term Structure of Interest Rates - CFA, FRM, and Actuarial Exams Study Notes

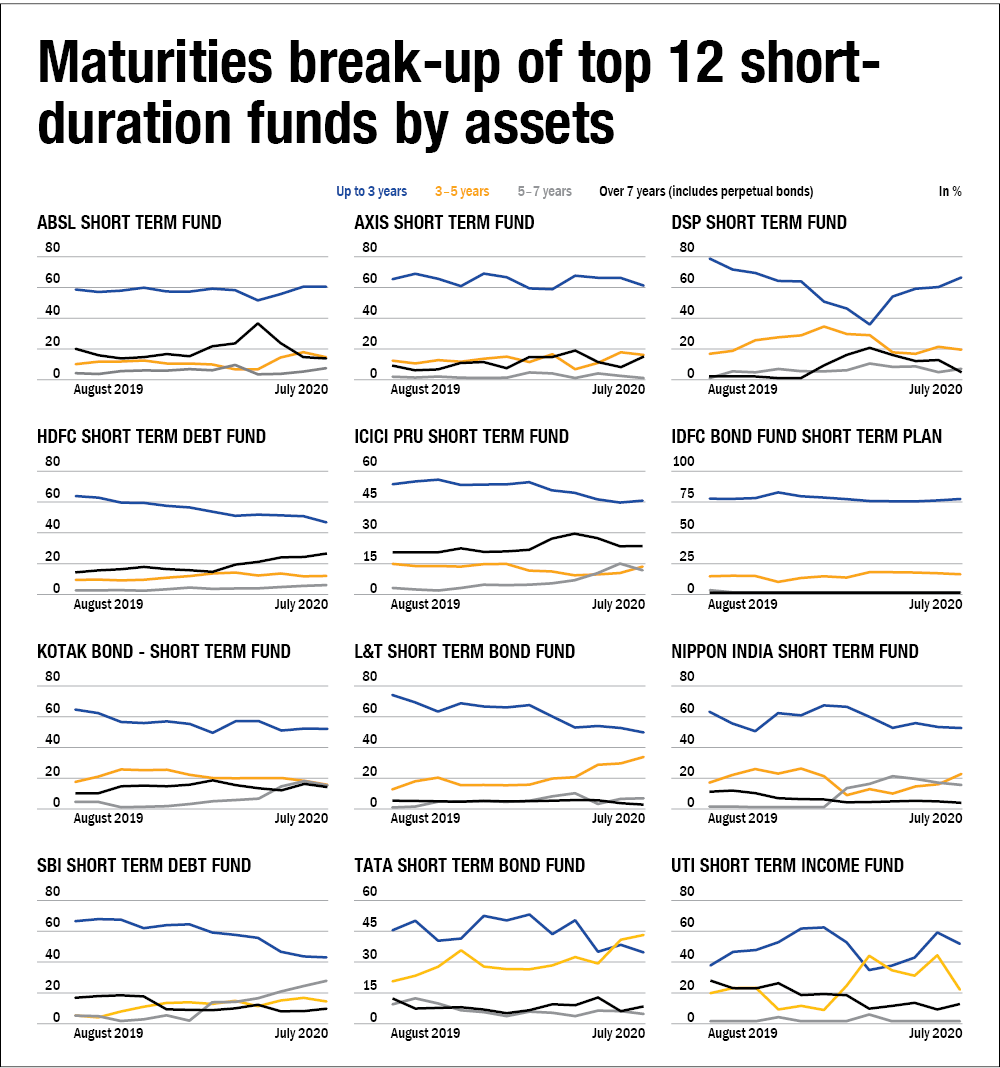

maturity debt funds: Constant maturity debt funds gain in long term whether rates rise or fall - The Economic Times

shows the Yield Curve obtained by the difference between long-term and... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/Commercial-paper-4199154-edit-ec6447e8a3a841a6bceb57e6b00f5c5f.jpg)

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)